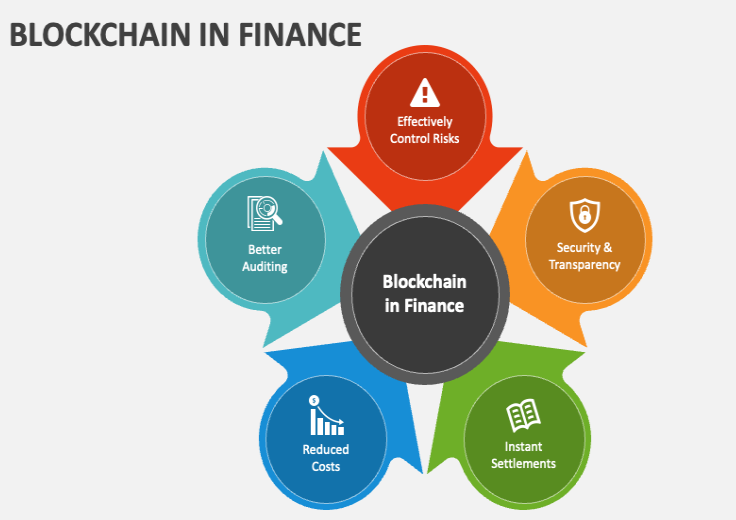

Blockchain technology has made a significant impact on the financial industry, offering new possibilities for improving transparency, security, and efficiency. The decentralized and distributed nature of blockchain has led to various applications within the financial sector.

Blockchain functions on a distributed network, removing the necessity for a central authority. This reduces the risk of single points of failure, enhances security, and removes the dependence on intermediaries.

The cryptographic nature of blockchain ensures secure and tamper-proof transactions. Once data is recorded on the blockchain, it cannot be easily altered, providing a high level of security against fraud and unauthorized access.

All transactions on the blockchain are transparent and can be viewed by authorized participants. This transparency enhances trust among parties and provides a clear and immutable record of financial transactions.

Blockchain streamlines processes by automating tasks through smart contracts. Transactions occur in real-time, reducing settlement times, minimizing delays, and enhancing overall operational efficiency.

Smart contracts execute predefined rules automatically when conditions are met, eliminating the need for intermediaries. This reduces the risk of errors, enhances efficiency, and accelerates the execution of contractual agreements.

Blockchain allows for borderless transactions, providing financial services on a global scale. Users can access financial services without traditional geographical restrictions, promoting financial inclusion.

To make requests for further information, Contact US